Reconciling your checkbook will help ensure you have adequate funds in your account, even if the check clears weeks or months after writing it.Īvailable funds & bank fees: If you make a transaction that exceeds the available funds in your account, you may be charged overdraft fees by your bank.

While banks typically refund these charges, the process can be expedited if you spot the transactions and report them as soon as possible.Ĭheck payment status: If you still fill out checks frequently, you’ve probably realized some checks get cashed long after you write them. The sooner you contact the merchant about these errors, the more likely they are to correct them in a timely manner.īudgeting & financial habits: Keeping an eye on your accounts and a record of your transactions can help you create better financial habits and make it easier to maintain a budget.įraudulent charges: If you become a victim of identity theft, an online scam or a stolen debit card, you may notice fraudulent charges in your account. Merchant errors: Merchants can also make payment processing mistakes, like charging you an incorrect amount or not processing a refund. By reconciling your account, you can ensure bill payments, deposits, transfers and other transactions are processed correctly. Here are a few other reasons why it can be beneficial to balance your accounts:īank errors: While bank errors are rare, they do happen occasionally. Reconciling your account on a regular basis helps ensure the bank’s records match your records, and that no transactional issues have occurred.

Practice for checkbook registers how to#

Let’s have a look at how to balance a checkbook in a digital world and why it’s still a solid practice to consider: Why balance your checkbook? Balancing your online checkbook is still a valuable practice that can help you catch accounting mistakes and foster better financial habits. Since most of us have 24/7 access to online banking and transaction records, you may be wondering whether it’s necessary to balance checkbook records in the modern financial world. Balancing a checkbook is the process of conducting a monthly reconciliation of your physical checkbook to make sure it matches the paper statement your bank mails out. He can be reached at 83.Back in the good ol’ days, when it was the norm to rent VHS tapes from Blockbuster and glanced down at pagers for work updates, the practice of balancing a checkbook was an important part of maintaining financial wellness. Most banks have user-friendly websites and will be happy to set you up with this service.īarry Dolowich is a certified public accountant and owner of a full-service accounting and tax practice with Monterey. In addition to reconciling your bank account, it is also a good idea to periodically review your account online for any unusual charges or transactions. Failure to timely reconcile your bank accounts can cost you money! If you do discover a bank error, report it to the bank immediately and be sure to follow up the correction. Please note that on occasion banks do make errors, or you could be the victim of identity or check theft. After a few months, you will become an expert at reconciling your checkbook and enjoy the satisfaction and peace of mind of knowing that you have an accurate balance.

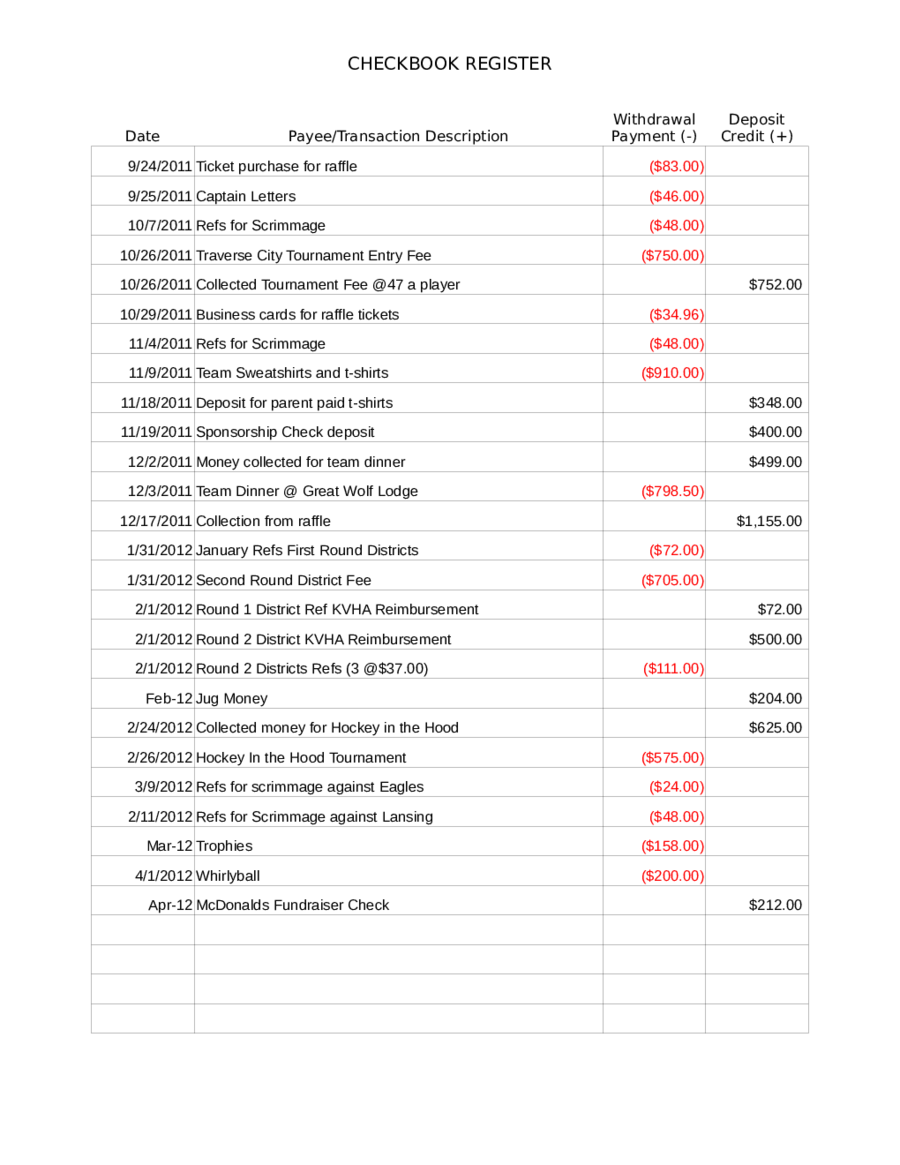

Most bank statements provide a reconciliation format as described above to help guide you through this process. The resulting total should equal the balance of your checkbook register. To balance, you need to subtract the outstanding checks and add the outstanding deposits to the ENDING bank statement balance. Once you have the above information, you are ready to reconcile your checkbook register balance to the bank statement balance. These are deposits you made that have not been credited to your account as of the ending date of the bank statement. You will also need to make a list of any outstanding deposits. These are checks that you have written, but have not been charged by the bank as of the ending date of the bank statement. You will need to make a list and total all outstanding checks. You may need to enter legitimate receipts or charges (i.e., interest income, bank charges and fees, etc.) in your register. To do this, you will need to “check” off all the items (deposits and withdrawals) in your check register that appear on the bank statement. The idea is to compare your checkbook register with the bank statement to be sure each entry is accurate and that the arithmetic is correct.

0 kommentar(er)

0 kommentar(er)